Knows the life cycle of your waste allowing you to reduce costs and control the waste generated by your company.

Dashboard with aggregated data and custom business indexes

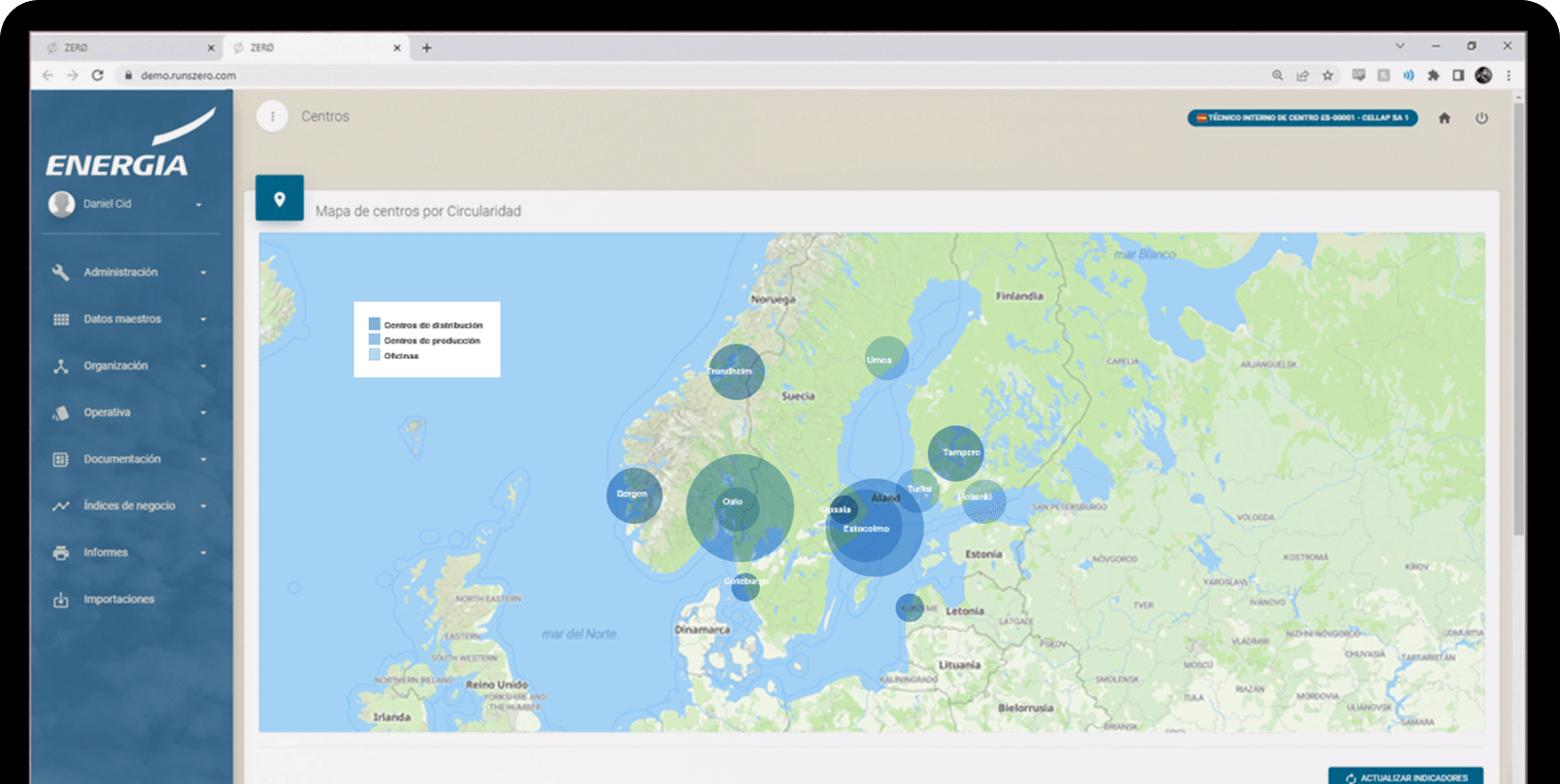

Adds value with data in real time

Promotes environmental sustainability strategies in your company

Establishes best practices for waste management

Achieves the traceability of all waste, hazardous and non-hazardous, from its origin to its end point (quantity, type, destination, treatment, outflows, etc.)

Provides access to organised, practical information at your fingertips